Free the Hops: Sin Taxes Drive Up the Cost of Beer

Free the Hops: Sin Taxes Drive Up the Cost of Beer

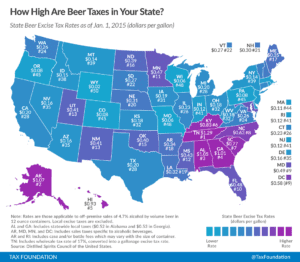

This article was featured in our weekly newsletter, the Liberator Online. To receive it in your inbox, sign up here. Your favorite frothy adult beverage would be a little cheaper if sin taxes were not part of the equation, according to a new report from the Tax Foundation, a nonpartisan policy research center. Each state taxes beer by the gallon, with the costs ranging from just 2 cents in Wyoming to $1.29 in Tennessee. “State and local governments use a variety of formulas to tax beer,” Scott Drenkard writes at the Tax Foundation. “The rates can include fixed per-volume taxes; wholesale taxes that are often a percentage of a product’s wholesale price; distributor taxes (sometimes structured as license fees as a percentage of revenues); case or bottle fees (which can vary based on size of container); and additional sales taxes (note that this measure does not include general sales tax, only those in excess of the general rate).” There is a trend to be found in the rates, as well. States in the Southeast tend to have the highest beer taxes. Seven of the top 10 states with the highest beer taxes are located in the area of the country known as the “Bible belt.” Northeastern states tend to have lower beer taxes.

What do you think?

Rate the degree to which government authorities should intervene on this issue:

Unlikely

Most likely

Jackson

Author

Advocates for Self-Government is nonpartisan and nonprofit. We exist to help you determine your political views and to promote a free, prosperous, and self-governing society.

Subscribe & Start Learning

What’s your political type? Find out right now by taking The World’s Smallest Political Quiz.