Jessica Corbett of Common Dreams

reports that the War on Terror, which the U.S. waged after the attacks on the World Trade Center on September 11, 2001, has cost 801,000 lives and $6.4 trillion.

A

pair of reports from the Costs of War Project at Brown University’s Watson Institute for International and Public Affairs revealed the steep human and financial costs of these military excursions.

According to the Costs of War Project co-director, Brown professor

Catherine Lutz, “the numbers continue to accelerate, not only because many wars continue to be waged, but also because wars don’t end when soldiers come home.”

Lutz added that these reports “provide a reminder that even if fewer soldiers are dying and the U.S. is spending a little less on the immediate costs of war today, the financial impact is still as bad as, or worse than, it was 10 years ago.” She argued, “We will still be paying the bill for these wars on terror into the 22nd century.”

The updated

Human Cost of Post-9/11 Wars report counts the number of “direct deaths” in major war zones. It divides people into civilians — humanitarian workers, NGO workers, journalists and media workers— and military forces — U.S. military members, Department of Defense civilians, contractors, members of national military and police forces, allied troops, and opposition fighters. The direct death totals are divided into six categories: Afghanistan, Pakistan, Iraq, Syria/ISIS, Yemen, and “Other.” Added together, the number of civilians who died in these conflicting regions is 335,734. Notably, this report did not include “indirect deaths, namely those caused by loss of access to food, water, and/or infrastructure, war-related disease, etc.”

Costs of War board member and American University professor David Vine argues that indirect deaths are “generally

estimated to be four times higher” than those

reported. He added, “This means that total deaths during the post-2001 U.S. wars in Afghanistan, Iraq, Syria, Pakistan, and Yemen are likely to reach 3.1 million or more —around 200 times the number of U.S. dead.” Vine finished by asking, “Don’t we have a responsibility to wrestle with our individual and collective responsibility for the destruction our government has inflicted?” Vine reveals an unsavory truth that our, “Our tax dollars and implied consent have made these wars possible. While the United States is obviously not the only actor responsible for the damage done in the post-2001 wars, U.S. leaders bear the bulk of responsibility for launching catastrophic wars that were never inevitable, that were wars of choice.”

Indeed, American policymakers have much to answer for regarding foreign policy. Global democratic crusading has been the M.O. of American policy since World War II. The U.S. has become the de facto World Police and is expected to solve all of the world’s problems. Making the world safe for democracy sounds great and all, but it comes with massive costs. The amount of blood and treasure the U.S. must expend along with the collateral damage that inevitably results from these conflicts is daunting. A constant state of war also facilitates the expansion of the state, as the defense sector grows larger and the government gains more power to spy on people. As the great writer, Randolph Bourne

proclaimed, “War is the health of the state.”

Although the justification for these wars sounds noble, there are insidious political forces in the shadows behind them. More often than not, these wars are total cash grabs for

defense contractors. By intervening non-stop, our political class overstretches American resources and leaves many servicemen vulnerable to attacks in hostile regions. No matter how we slice it, other countries will have to pick up the slack and defend their own interests. The paradigm of foreign interventionism is heavily facilitated by central banking and income taxation. Under a system of sound money and no income tax, it would be much harder for the political class to launch these wars of choice.

Donald Trump was elected in 2016 on a platform to end these conflicts. Sadly, there is strong institutional inertia within his own administration preventing withdrawal from hotspots like

Afghanistan. This is where the U.S. finds itself these days. Endless wars run contrary to the Founding Fathers’ vision of a non-interventionist foreign policy that emphasized the avoidance of entangling alliances. The U.S. will need to take a radically different foreign policy path soon, lest it ends up like previous empires which imploded due to their zealous overreach.

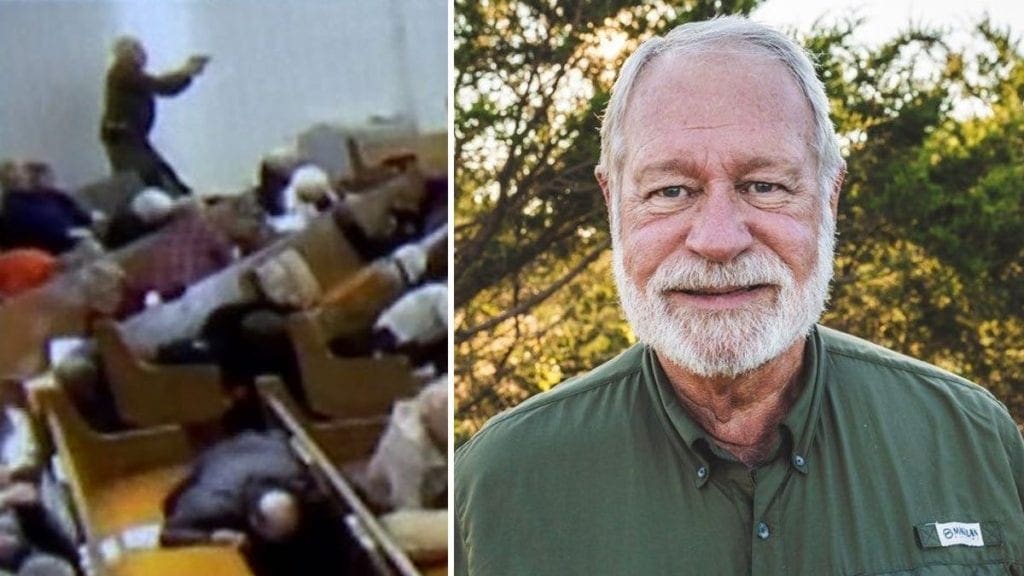

More bloodshed could have resulted had it not been for the efforts of armed citizens who immediately responded to the assailant. One of them, Jack Wilson, was able to take out the shooter.

“The events at West Freeway Church of Christ put me in a position I would hope no one would have to be in, but evil exists and I had to take out an active shooter in church,” Wilson posted on Facebook.

Other parishioners drew out their weapons, but Wilson was the one who was able to neutralize the gunman. Wilson’s heroic actions were well-received by members of the church and Texas political officials.

“We lost two great men today, but it could have been a lot worse,” the church’s Senior Minister Britt Farmer asserted on Sunday. “I’m thankful our government has allowed us the opportunity to protect ourselves.”

“The citizens who were inside that church undoubtedly saved 242 other parishioners, and that might get swept aside,” Texas Department of Public Safety Director Jeoff Williams stated. “It was miraculous. The true heroes in all this are the people who were sitting in those pews today and responded, the immediate responders … it was truly heroic.”

Texas’ gun laws afford considerable Second Amendment freedoms compared to other states. Although many gun rights activists, like myself, have voiced my displeasure with the Texas legislature’s reluctance to embrace more extensive pro-gun measures, such as constitutional carry, the state still remains relatively friendly to gun owners. In fact, Texas’ current gun laws allowed for an individual like Jack Wilson and other armed law-abiding parishioners to intervene and prevent a possible bloodbath.

Further, a 2017 law championed by former state representative and pro-gun advocate, Matt Rinaldi, allowed churches to have armed volunteer security. Such a law may have played a role in preventing a much larger massacre from taking place, although Texas does allow for churches to set their own policies in determining who gets to carry and who doesn’t.

The killer, Keith Thomas Kinnunen, had an extensive criminal record of aggravated assault, theft, and illegal weapon possession. This incident is a firm reminder that even the most common sense of gun control laws — prohibiting felons from acquiring firearms — will likely not stop evil people from committing heinous acts. Additionally, we need to start talking about criminal justice reforms that keep the most dangerous people away from the rest of society. Regardless, no laws are perfect, and evil will find a way to slip through the cracks. That’s why there must be fallback measures such as personal defense.

Armed citizens like Jack Wilson highlight how law-abiding individuals can be the last line of defense against deranged criminals.

More bloodshed could have resulted had it not been for the efforts of armed citizens who immediately responded to the assailant. One of them, Jack Wilson, was able to take out the shooter.

“The events at West Freeway Church of Christ put me in a position I would hope no one would have to be in, but evil exists and I had to take out an active shooter in church,” Wilson posted on Facebook.

Other parishioners drew out their weapons, but Wilson was the one who was able to neutralize the gunman. Wilson’s heroic actions were well-received by members of the church and Texas political officials.

“We lost two great men today, but it could have been a lot worse,” the church’s Senior Minister Britt Farmer asserted on Sunday. “I’m thankful our government has allowed us the opportunity to protect ourselves.”

“The citizens who were inside that church undoubtedly saved 242 other parishioners, and that might get swept aside,” Texas Department of Public Safety Director Jeoff Williams stated. “It was miraculous. The true heroes in all this are the people who were sitting in those pews today and responded, the immediate responders … it was truly heroic.”

Texas’ gun laws afford considerable Second Amendment freedoms compared to other states. Although many gun rights activists, like myself, have voiced my displeasure with the Texas legislature’s reluctance to embrace more extensive pro-gun measures, such as constitutional carry, the state still remains relatively friendly to gun owners. In fact, Texas’ current gun laws allowed for an individual like Jack Wilson and other armed law-abiding parishioners to intervene and prevent a possible bloodbath.

Further, a 2017 law championed by former state representative and pro-gun advocate, Matt Rinaldi, allowed churches to have armed volunteer security. Such a law may have played a role in preventing a much larger massacre from taking place, although Texas does allow for churches to set their own policies in determining who gets to carry and who doesn’t.

The killer, Keith Thomas Kinnunen, had an extensive criminal record of aggravated assault, theft, and illegal weapon possession. This incident is a firm reminder that even the most common sense of gun control laws — prohibiting felons from acquiring firearms — will likely not stop evil people from committing heinous acts. Additionally, we need to start talking about criminal justice reforms that keep the most dangerous people away from the rest of society. Regardless, no laws are perfect, and evil will find a way to slip through the cracks. That’s why there must be fallback measures such as personal defense.

Armed citizens like Jack Wilson highlight how law-abiding individuals can be the last line of defense against deranged criminals.

The FBI’s 2018 “Crime in the United States” report collected crime data from law enforcement agencies across America. From the looks of it, the news is good.

The FBI

The FBI’s 2018 “Crime in the United States” report collected crime data from law enforcement agencies across America. From the looks of it, the news is good.

The FBI

Jones’ stewardship of the UAW had gained notoriety for corruption and trouble was brewing in UAW-land throughout 2019. Last August, the FBI

Jones’ stewardship of the UAW had gained notoriety for corruption and trouble was brewing in UAW-land throughout 2019. Last August, the FBI

“The next wave of deregulation reform, announced by Prime Minister Scott Morrison, is a step in the right direction to make it easier for small businesses to employ staff and invest in growth,” Carnell stated.

She also stated the following:

“Of particular interest is the government’s plan to deal with the degree of regulatory complexity, the length of time for approvals and duplication across levels of government. This has the potential to be a game-changer for Australia’s 2.3 million small businesses and family enterprises. We will continue to work with the government to achieve the best possible outcomes for the small business sector.”

Once implemented, this program will be good news for Australia.

Australia seems to be following in America’s positive footsteps by pursuing a deregulation agenda. The Trump administration has already set a positive tone on deregulation by signing an

“The next wave of deregulation reform, announced by Prime Minister Scott Morrison, is a step in the right direction to make it easier for small businesses to employ staff and invest in growth,” Carnell stated.

She also stated the following:

“Of particular interest is the government’s plan to deal with the degree of regulatory complexity, the length of time for approvals and duplication across levels of government. This has the potential to be a game-changer for Australia’s 2.3 million small businesses and family enterprises. We will continue to work with the government to achieve the best possible outcomes for the small business sector.”

Once implemented, this program will be good news for Australia.

Australia seems to be following in America’s positive footsteps by pursuing a deregulation agenda. The Trump administration has already set a positive tone on deregulation by signing an

Since the Islamic Revolution of 1979, Iran has been a thorn in the side of the American political establishment. This has prompted politicians from both parties to take harsh action against the country. In 1979, sanctions were

Since the Islamic Revolution of 1979, Iran has been a thorn in the side of the American political establishment. This has prompted politicians from both parties to take harsh action against the country. In 1979, sanctions were

The program, which Vermont Senator Bernie Sanders is promoting in his 2020 presidential campaign, would have the state take on a greater role in America’s economy. According to his campaign website, Medicare for All would

The program, which Vermont Senator Bernie Sanders is promoting in his 2020 presidential campaign, would have the state take on a greater role in America’s economy. According to his campaign website, Medicare for All would

A

A

Powell informed the Joint Economic Committee that the “high and rising federal debt” could make future recoveries from economic downturns much more difficult.

“Over time, this outlook could reduce fiscal policymakers’ willingness or ability to support economic activity during a downturn. In addition, I remain concerned that the high and rising federal debt can in the longer term restrain private investment and thereby reduce productivity and overall growth,” Powell added.

The fiscal chickens are coming home to roost in America and this may not look pretty for future generations. Last month the Congressional Budget Office (CBO) reported that the deficit stood at

Powell informed the Joint Economic Committee that the “high and rising federal debt” could make future recoveries from economic downturns much more difficult.

“Over time, this outlook could reduce fiscal policymakers’ willingness or ability to support economic activity during a downturn. In addition, I remain concerned that the high and rising federal debt can in the longer term restrain private investment and thereby reduce productivity and overall growth,” Powell added.

The fiscal chickens are coming home to roost in America and this may not look pretty for future generations. Last month the Congressional Budget Office (CBO) reported that the deficit stood at

Unions are a natural constituency of the Democratic Party. According to Open Secrets, unions

Unions are a natural constituency of the Democratic Party. According to Open Secrets, unions

In his

In his

Trump has clashed with Powell in the past over his reluctance to lower interest rates down to zero or even into negative territory. Although the economy could be in much worse shape, Trump’s monetary suggestions should have Americans worried. Economist Peter Schiff raised valid points about Donald Trump’s

Trump has clashed with Powell in the past over his reluctance to lower interest rates down to zero or even into negative territory. Although the economy could be in much worse shape, Trump’s monetary suggestions should have Americans worried. Economist Peter Schiff raised valid points about Donald Trump’s